In the last Republican debate, Senator Rand Paul voiced support for three different plans to balance the budget, including a proposal to do so over five years by decreasing outlays by one percent per year. Would this be successful? It could be, but it would also depend on the level of revenues. First, let’s look at how an annual one percent reduction could impact outlays.

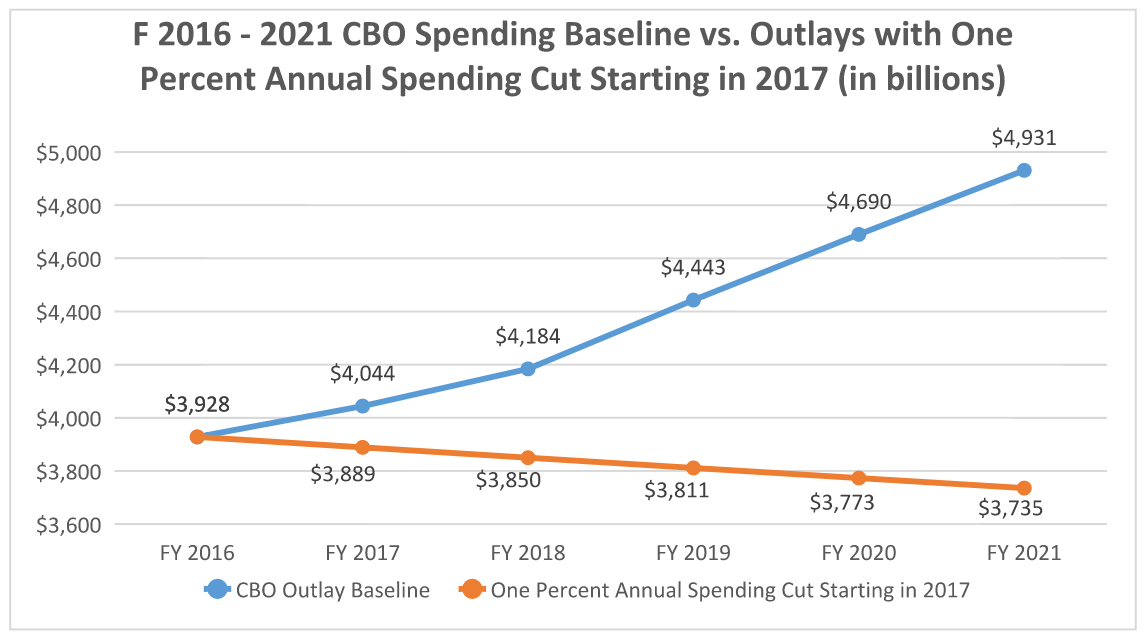

Under the Congressional Budget Office’s August 2015 budget outlook, federal spending is expected to total $3.9 trillion in 2016 and increase by an average of five percent over the next five years, reaching $4.9 trillion in 2021.

If a one percent annual reduction is started in 2017 and maintained over the next five years – a key point to consider because recent budget history has shown that lawmakers will not long abide by spending caps – outlays would continue on a downward track. By 2021 outlays will have fallen to $3.7 trillion – $1.2 trillion less than CBO’s current forecast. Over the five year period, total spending would be reduced by $3.2 trillion compared to the CBO baseline.

How would this compare with current revenues? CBO projects tax receipts and other income will amount to $3.5 trillion in 2016 and grow by an average of 3 percent per year, reaching $4.2 trillion in 2021.

Compared to the CBO baseline, revenues would exceed outlays in 2019 by $36 billion in 2019, $231 billion in 2020, and $429 billion in 2021.

Paul has also proposed a tax reform plan to eliminate the payroll tax and institute a 14.5 percent flat rate on all types of income. The Tax Foundation calculated that, over a ten-year period, Paul’s tax reform would generate $1.8 trillion less in revenues, but under a dynamic analysis, revenues would be $737 billion higher. A five-year forecast of revenues under Paul’s tax reform plan is currently unavailable. But even if annual receipts are $200 billion lower per year than CBO’s forecast, it would only take an additional year before the budget is balanced. Paul’s one percent annual reduction would generate a $31 billion surplus in 2020 and $229 billion in 2021.

There is one caveat: a one percent reduction could not be applied to the obligated net interest payments on the national debt. In 2016, CBO projects that debt payments will cost $261 billion in 2016 and are on track to more than double over five years to $553 billion in 2021.

Cutting spending now will alleviate debt payments over the long term, but over the shorter term, some programs would need to be cut back by more than one percent to stick to the goal of attaining a balanced budget over five years.

Oops! Something went wrong while submitting the form